Anyone knows that car insurance companies don’t want their customers to go rate shopping. People who shop around once a year are highly likely to buy a new policy because they have good chances of finding a more affordable policy premium. A survey found that consumers who did price comparisons regularly saved an average of $3,450 over four years compared to people who don’t regularly compare prices.

If finding the most affordable car insurance in El Paso is your ultimate target, then learning about how to get rate quotes and compare cheaper coverage can make it simple to find affordable coverage.

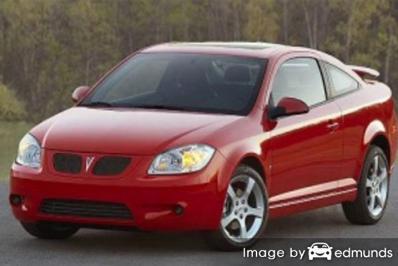

The best way we recommend to get discount Pontiac G5 insurance in El Paso is to start doing an annual price comparison from insurers that insure vehicles in Texas. This can be done by following these steps.

The best way we recommend to get discount Pontiac G5 insurance in El Paso is to start doing an annual price comparison from insurers that insure vehicles in Texas. This can be done by following these steps.

- Step 1: Try to learn about how your policy works and the measures you can take to keep rates low. Many rating criteria that result in higher rates like distracted driving and a negative credit rating can be controlled by making minor changes in your lifestyle. Read the full article for more details to get low prices and get bigger discounts.

- Step 2: Compare rates from direct carriers, independent agents, and exclusive agents. Exclusive and direct companies can only quote rates from a single company like GEICO or Farmers Insurance, while agents who are independent can quote rates from multiple insurance companies.

- Step 3: Compare the new rate quotes to your current policy and determine if there is any savings. If you can save money and change companies, make sure there is no lapse in coverage.

- Step 4: Give notification to your current company to cancel your current coverage. Submit the signed application along with the required initial payment for the new coverage. Be sure to place the new proof of insurance certificate in your vehicle’s glove compartment or console.

One key aspect when comparing rates is to make sure you enter the same level of coverage on each quote and and to get price estimates from as many carriers as you can. This enables an apples-to-apples comparison and the best price selection.

The quickest method to compare car insurance rates for Pontiac G5 insurance in El Paso is to understand most of the larger companies provide online access to provide you with a free rate quote. All you need to do is give them rating details such as if you lease or own, an estimate of your credit level, how much you drive, and if you have an active license. That rating information is instantly provided to all major companies and they return quotes instantly.

To compare multiple company cheaper Pontiac G5 insurance rates now, click here and find out if you can get cheaper insurance in El Paso.

The providers in the list below provide quotes in Texas. If several companies are displayed, we recommend you get rates from several of them to find the cheapest car insurance rates.

Here’s why insurance is not optional

Even though it’s not necessarily cheap to insure a Pontiac in El Paso, buying insurance is not optional due to several reasons.

- The majority of states have mandatory liability insurance requirements which means you are required to carry a specific level of liability coverage if you want to drive legally. In Texas these limits are 30/60/25 which means you must have $30,000 of bodily injury coverage per person, $60,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

- If you have a loan on your vehicle, most lenders will stipulate that you buy insurance to ensure the loan is repaid in case of a total loss. If you do not pay your insurance premiums, the bank or lender will purchase a policy for your Pontiac for a lot more money and require you to pay for the much more expensive policy.

- Insurance preserves not only your Pontiac but also your assets. Insurance will also pay for all forms of medical expenses that are the result of an accident. One policy coverage, liability insurance, also covers legal expenses if you are sued as the result of your driving. If your Pontiac gets damaged, collision and comprehensive coverages will pay to repair the damage minus the deductible amount.

The benefits of having insurance outweigh the cost, especially when you need to use it. In a recent study of 1,000 drivers, the average customer is overpaying more than $825 a year so compare rates each time the policy renews to be sure current rates are still competitive.

Situations that may require an agent’s advice

Always remember that when buying a policy, there really is not a “best” method to buy coverage. Your situation is unique.

For instance, these questions may help you determine if your situation might need professional guidance.

- Are split liability limits better than a combined single limit?

- Is other people’s property covered if stolen from my vehicle?

- Do I need more liability coverage?

- How can I get high-risk coverage after a DUI?

- Does my insurance cover damage caused when ticketed for reckless driving?

- Can I rent a car in Mexico?

- What are the financial responsibility laws in my state?

- Does rental coverage apply when I am renting a car?

- Will my Pontiac G5 be repaired with OEM or aftermarket parts?

- Is my Pontiac G5 covered if I use it for business?

If you’re not sure about those questions but a few of them apply, then you may want to think about talking to a licensed insurance agent. To find an agent in your area, fill out this quick form. It is quick, free and may give you better protection.

The coverage is in the details

Understanding the coverages of insurance aids in choosing which coverages you need for your vehicles. Insurance terms can be confusing and even agents have difficulty translating policy wording.

Comprehensive coverages

This covers damage that is not covered by collision coverage. A deductible will apply and then insurance will cover the rest of the damage.

Comprehensive can pay for things such as rock chips in glass, theft, damage from a tornado or hurricane, fire damage and vandalism. The maximum payout your insurance company will pay is the market value of your vehicle, so if the vehicle is not worth much consider dropping full coverage.

Uninsured and underinsured coverage

This gives you protection from other motorists when they either have no liability insurance or not enough. It can pay for injuries sustained by your vehicle’s occupants as well as damage to your Pontiac G5.

Since many Texas drivers only carry the minimum required liability limits (which is 30/60/25), their liability coverage can quickly be exhausted. That’s why carrying high Uninsured/Underinsured Motorist coverage is important protection for you and your family. Normally these coverages are identical to your policy’s liability coverage.

Coverage for medical payments

Medical payments and Personal Injury Protection insurance reimburse you for expenses for funeral costs, prosthetic devices and hospital visits. They are often used to fill the gap from your health insurance program or if there is no health insurance coverage. They cover both the driver and occupants as well as getting struck while a pedestrian. Personal injury protection coverage is only offered in select states and gives slightly broader coverage than med pay

Auto liability

This coverage provides protection from damage or injury you incur to people or other property in an accident. This insurance protects YOU from legal claims by others. Liability doesn’t cover damage sustained by your vehicle in an accident.

Coverage consists of three different limits, bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. Your policy might show liability limits of 30/60/25 that means you have a $30,000 limit per person for injuries, a per accident bodily injury limit of $60,000, and property damage coverage for $25,000. Occasionally you may see a combined single limit or CSL which provides one coverage limit without having the split limit caps.

Liability coverage protects against claims such as structural damage, attorney fees and bail bonds. How much coverage you buy is a personal decision, but you should buy as high a limit as you can afford. Texas state law requires minimum liability limits of 30/60/25 but drivers should carry more coverage.

The chart below shows why buying minimum limits may not provide you with enough coverage.

Auto collision coverage

Collision coverage covers damage to your G5 resulting from a collision with another vehicle or an object, but not an animal. You have to pay a deductible then your collision coverage will kick in.

Collision coverage pays for things such as hitting a mailbox, colliding with a tree, sustaining damage from a pot hole, damaging your car on a curb and driving through your garage door. Collision is rather expensive coverage, so you might think about dropping it from older vehicles. Another option is to raise the deductible on your G5 to bring the cost down.

El Paso car insurance companies ranked

Selecting a highly-rated auto insurance provider can be difficult considering how many different insurance companies sell coverage in Texas. The rank data displayed below can help you analyze which car insurance providers you want to consider comparing prices from.

Top 10 El Paso Car Insurance Companies by A.M. Best Rank

- Travelers – A++

- USAA – A++

- GEICO – A++

- State Farm – A++

- Titan Insurance – A+

- Esurance – A+

- Progressive – A+

- The Hartford – A+

- Allstate – A+

- Nationwide – A+

Top 10 El Paso Car Insurance Companies Ranked by Claims Service

- Travelers

- Nationwide

- Allstate

- State Farm

- Liberty Mutual

- GEICO

- American Family

- Esurance

- Titan Insurance

- AAA Insurance

Final considerations

You just learned many tips how you can find lower-cost Pontiac G5 insurance in El Paso. It’s most important to understand that the more companies you get rates for, the higher your chance of finding low cost El Paso auto insurance quotes. Drivers may even discover the best price on car insurance is with the smaller companies.

Cost effective Pontiac G5 insurance is definitely available both online in addition to many El Paso insurance agents, so get free El Paso auto insurance quotes from both of them to have the best chance of lowering rates. There are still a few companies who do not offer online quoting and most of the time these smaller providers only sell coverage through independent agencies.

Insureds leave their current company for many reasons like policy non-renewal, delays in responding to claim requests, an unsatisfactory settlement offer or even unfair underwriting practices. It doesn’t matter what your reason, choosing a new insurance company is pretty simple and you could end up saving a buck or two.

More articles

- Car Insurance FAQ (Trusted Choice)

- Determining Your Vehicle’s Value and Repair Cost (Insurance Information Institute)

- Winter Driving (Insurance Information Institute)

- Rollover Crash FAQ (iihs.org)

- Alcohol Impaired Driving FAQ (iihs.org)