Sad but true, the vast majority of consumers in Texas have purchased from the same company for four years or more, and approximately 38% of consumers have never compared auto insurance rates at all. Many consumers in the U.S. could save roughly 47% each year by just shopping around, but they don’t want to spend time to find affordable auto insurance rates.

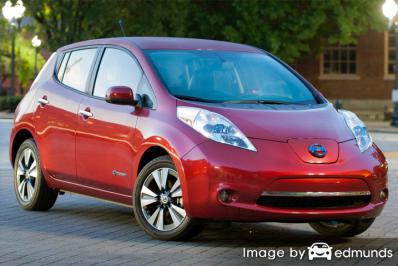

If you want to save the most money, the best way to find cheaper Nissan Leaf insurance in El Paso is to compare prices regularly from insurance carriers who sell auto insurance in Texas. You can shop around by following these steps.

If you want to save the most money, the best way to find cheaper Nissan Leaf insurance in El Paso is to compare prices regularly from insurance carriers who sell auto insurance in Texas. You can shop around by following these steps.

- Spend some time learning about how car insurance works and the measures you can take to lower rates. Many rating criteria that cause high rates like accidents, traffic tickets, and a low credit score can be improved by making lifestyle changes or driving safer.

- Obtain price quotes from exclusive agents, independent agents, and direct providers. Direct companies and exclusive agencies can only give rate quotes from one company like Progressive or Farmers Insurance, while independent agencies can provide rate quotes for many different companies.

- Compare the new quotes to your current policy to determine if switching companies saves money. If you find a better price, make sure there is no lapse in coverage.

An important bit of advice to remember is to make sure you enter similar deductibles and liability limits on each quote and and to get rate quotes from as many different companies as possible. This guarantees a fair rate comparison and a better comparison of the market.

If you currently have insurance, you will most likely be able to cut your premiums using the ideas presented in this article. Buying the cheapest insurance in El Paso is really quite easy. Although Texas drivers must know how the larger insurance companies determine what you pay because rates are impacted by many factors.

Cheap companies for Nissan Leaf insurance in Texas

The companies shown below are ready to provide comparison quotes in El Paso, TX. If the list has multiple companies, we suggest you get rates from several of them to get the best price comparison.

How to Lower Your Insurance Premiums

A large part of saving on insurance is knowing some of the factors that play a part in calculating your premiums. If you have a feel for what determines premiums, this empowers consumers to make smart changes that can earn you cheaper rates. Many factors are taken into consideration when premium rates are determined. Most are fairly basic like a motor vehicle report, although others are less obvious like your continuous coverage or your financial responsibility.

You may save more by bundling policies – Many insurers will award lower prices to insureds that have more than one policy, otherwise known as a multi-policy discount. Even if you’re getting this discount you still need to compare other company rates to make sure you are getting the best deal.

Drive a safer car and pay less – Safer cars tend to be cheaper to insure. Highly rated vehicles help reduce the chance of injuries in an accident and fewer injuries means lower claim amounts passed on to you as lower rates.

Buy as much liability insurance as you can afford – Liability coverage provides coverage if you are found liable for personal injury or accident damage. It provides you with a defense in court which can cost a lot. Liability insurance is quite affordable compared to other policy coverages, so do not cut corners here.

High comp and collision deductibles equal low rates – Physical damage insurance, commonly called comprehensive (or other-than-collision) and collision coverage, covers damage that occurs to your Nissan. Some examples of covered claims would be a broken windshield, collision with an animal, and burglary. The deductibles define the amount you are willing to pay out-of-pocket if a claim is determined to be covered. The higher the amount you have to pay, the less your insurance will be.

City dwellers may pay more – Living in a rural area can be a good thing when shopping for auto insurance. Less people translates into fewer accidents in addition to lower liability claims. Residents of big cities tend to have congested traffic and more time behind the wheel. More time behind the wheel means more chances of being involved in an auto accident.

Alarms and GPS tracking lower rates – Choosing a vehicle with a theft deterrent system can save you some money. Theft prevention features like GM’s OnStar, tamper alarm systems and vehicle immobilizers all aid in stopping your car from being stolen.

Don’t abuse insurance claims – If you are a frequent claim filer, you should expect either policy cancellation or increased premiums. Car insurance companies in Texas give the lowest premiums to people who are claim-free. Your insurance policy is designed for claims that pose a financial burden.

Discounts for married drivers – Being married may earn you lower rates on your policy. It translates into being more mature than a single person and it’s proven that drivers who are married file infrequent claims.

Nissan Leaf claim statistics – Companies use statistical claims data to help calculate a profitable premium price. Models that historically have high amounts or severity of claims will cost more to insure. The next table shows the loss history for Nissan Leaf vehicles.

For each coverage type, the claim amount for all vehicles as a whole is represented as 100. Values that are under 100 suggest losses that are better than average, while numbers shown that are more than 100 indicate more frequent claims or a tendency for losses to be larger than average.

| Vehicle Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| Nissan Leaf Electric | 89 | 84 | 45 | 83 | 64 | 76 |

Statistics from IIHS.org for 2013-2015 Model Years

Save with these rate reducing discounts

Insuring your fleet can be pricey, but there could be significant discounts to help offset the cost. Some discounts apply automatically when you purchase, but lesser-known reductions have to be asked for prior to getting the savings.

- Discount for Swiching Early – A few companies allow discounts for signing up prior to your current Leaf insurance policy expiring. You could save around 10% when you buy El Paso car insurance online.

- Active Service Discounts – Being on active duty in the military could qualify you for better premium rates.

- E-sign – Certain auto insurance companies provide a small discount for completing your application on your computer.

- Discounts for Good Drivers – Insureds who avoid accidents can pay as much as 50% less than drivers with accidents.

- Home Ownership Discount – Simply owning a home can get you a discount since home ownership shows financial diligence.

- Theft Deterrent Discount – Cars, trucks, and SUVs optioned with advanced anti-theft systems prevent vehicle theft and that can save you a little bit as well.

- Resident Student – Kids who are enrolled in a college that is more than 100 miles from El Paso and don’t have a car may qualify for this discount.

- Safety Course Discount – Taking part in a class that teaches defensive driving techniques could save 5% or more and also improve your driving technique.

- ABS and Traction Control Discounts – Cars that have anti-lock braking systems are much safer to drive and therefore earn up to a 10% discount.

- Mature Driver Discount – If you’re over the age of 55, you could receive reduced rates.

You should keep in mind that most credits do not apply to the entire cost. Most only cut individual premiums such as comprehensive or collision. So even though you would think it’s possible to get free car insurance, it just doesn’t work that way.

A partial list of companies that possibly offer some of the discounts shown above are:

Before buying, ask all the companies how you can save money. A few discounts might not apply in El Paso. If you would like to view companies that have a full spectrum of discounts in Texas, click here.

Exclusive versus independent auto insurance agents

Many people still like to visit with an insurance agent and we recommend doing that A good thing about comparing rates online is that you can obtain lower rates and still have an agent to talk to.

For easy comparison, once you complete this quick form, the quote information is instantly submitted to agents in your area who will gladly provide quotes to get your business. There is no need to contact any insurance agencies since rate quotes are delivered to you directly. You can get cheaper car insurance rates and a licensed agent to work with. If you need to compare prices for a specific company, feel free to find their quoting web page and fill out the quote form the provide.

Finding the right provider requires you to look at more than just a cheap price. Any agent in El Paso should be forthright in answering these questions:

- Is the agency covered by Errors and Omissions coverage?

- Is the quote a firm price?

- If they are an independent agency in El Paso, which companies do they recommend?

- Can you use your own choice of collision repair facility?

- Are you getting all the discounts the company offers?

How to choose the best auto insurance agent in El Paso

When searching for a reliable agent, you must know there are a couple types of agencies from which to choose. Agents can be categorized as either independent or exclusive.

Exclusive Agents

Exclusive insurance agents can only quote rates from one company like State Farm, Allstate, or Farmers Insurance. Exclusive agents cannot compare rates from other companies so keep that in mind. Exclusive agents are usually well trained on their company’s products which helps them sell insurance even at higher premiums.

Shown below are exclusive agencies in El Paso who may provide you with comparison quotes.

Rafael Martinez – State Farm Insurance Agent

7211 N Mesa St #2w – El Paso, TX 79912 – (915) 581-3276 – View Map

Carlos Robles – State Farm Insurance Agent

12025 Rojas Dr Ste E – El Paso, TX 79936 – (915) 856-7758 – View Map

Eric Fierro – State Farm Insurance Agent

2200 N Yarbrough Dr c – El Paso, TX 79925 – (915) 595-3622 – View Map

Independent Agencies or Brokers

Independent agents do not have single company limitations so they can quote policies with a variety of different insurance companies and possibly get better coverage at lower prices. If you want to switch companies, they simply move your policy to a different company and you don’t have to do anything. When comparing car insurance rates, you will definitely want to include price quotes from several independent insurance agents to get the best comparison.

Below is a list of independent agencies in El Paso that are able to give price quote information.

American Agency Insurance

5959 Gateway Blvd W #533 – El Paso, TX 79925 – (915) 772-7766 – View Map

Red Rock Insurance Agency

9109 Dyer St f – El Paso, TX 79924 – (915) 759-9000 – View Map

Asegura Insurance Agency

1155 N Zaragoza Rd #105 – El Paso, TX 79907 – (915) 613-4800 – View Map

A little work can save a LOT of money

In this article, we presented a lot of information how to find lower-cost Nissan Leaf insurance in El Paso. It’s most important to understand that the more price quotes you have, the higher your chance of finding inexpensive El Paso car insurance quotes. Drivers may even discover the most savings is with some of the smallest insurance companies. Smaller companies can often insure niche markets at a lower cost than their larger competitors like State Farm, GEICO and Nationwide.

When searching for low cost El Paso car insurance quotes, make sure you don’t skimp on critical coverages to save a buck or two. There have been many situations where drivers have reduced physical damage coverage and learned later that their decision to reduce coverage ended up costing them more. Your aim should be to buy the best coverage you can find for the lowest cost, but do not sacrifice coverage to save money.

Additional information

- Rental Reimbursement Coverage (Allstate)

- Prom Night Tips for Teen Drivers (State Farm)

- Airbag FAQ (iihs.org)

- Auto Insurance Basics (Insurance Information Institute)

- Eight Auto Insurance Myths (Insurance Information Institute)